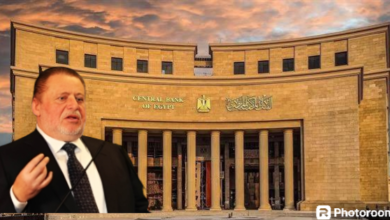

Central Bank of Egypt Launches Banking Reform & Development Fund to Modernize Sector

Kahamaty-New

In a strategic move to advance Egypt’s banking sector in line with global standards, the Central Bank of Egypt (CBE) has officially launched the Banking Reform and Development Fund, appointing Governor Hassan Abdalla as Chairman of its Board of Directors for a four-year term.

The Fund, established under Law No. 194 of 2020, aims to modernize and enhance the efficiency, resilience, and competitiveness of the Egyptian banking sector. It will serve as a critical engine for upgrading digital infrastructure, expanding financial inclusion, and driving innovation across financial services.

The newly formed board comprises 11 members, including top officials from the CBE and leading figures in banking and technology. Among them are:

Rami Aboulnaga, Deputy Governor for Monetary Policy

Tarek ElKholy, Deputy Governor for Banking Stability

Five bank CEOs elected by the Federation of Egyptian Banks (FEB), including:

Mohamed El-Etreby (National Bank of Egypt)

Mohamed Abbas Fayed (FABMISR)

Akef El Maghraby (Suez Canal Bank)

Tamer Waheed (Arab African International Bank)

Mohamed Abdelkader (Citibank Egypt)

The board also includes three independent industry experts:

Mohamed Abdallah, CEO of Vodafone Egypt

Eng. Hoda Mansour, Vice Chair at Sukari Gold Mines

Tarek Abdel-Rahman, CEO of Bonyan for Development and Trade

During the Fund’s inaugural meeting, chaired by Governor Abdalla, the board outlined a strategic roadmap and governance framework focused on technological advancement, cybersecurity resilience, and capacity-building across the sector.

> “This Fund is a cornerstone in our national strategy to future-proof the banking sector,” said Governor Abdalla. “By integrating diverse expertise and global best practices, we aim to foster sustainable growth and digital innovation in Egypt’s financial ecosystem.”

The Banking Reform and Development Fund operates as a legally independent entity affiliated with the CBE, with autonomous governance and financial oversight. It brings together all Egyptian banks as members and is empowered to:

Support national payment system infrastructure

Advance FinTech and digital transformation

Mitigate and recover from cybersecurity threats

Develop banking products and services

Promote financial literacy and inclusion

The Fund also has the legal authority to establish or invest in joint-stock companies, and to enter into cooperation agreements with local and international institutions to exchange knowledge and drive innovation.

This initiative underscores Egypt’s commitment to building a robust, inclusive, and future-ready banking sector, aligned with the country’s Vision 2030 for sustainable economic development.